5 Easy Facts About Summit Business Advisors Llc Described

Table of ContentsThe smart Trick of Summit Business Advisors Llc That Nobody is Talking AboutThe Facts About Summit Business Advisors Llc UncoveredThe 30-Second Trick For Summit Business Advisors LlcThe smart Trick of Summit Business Advisors Llc That Nobody is Talking About

Our writers and editors used an internal all-natural language generation system to assist with portions of this article, permitting them to focus on adding information that is uniquely helpful. The short article was evaluated, fact-checked and edited by our content staff before publication. When it pertains to handling your money, you do not want anybody messing it up and that includes you.Some people might desire to get a residence quickly while others are focusing on saving for retired life. A great economic consultant thinks about your family members, age, profession and priorities when crafting your financial goals, and afterwards assists you discover how to reach them. Goals change.

Whether you have one main objective or several, a monetary expert is your overview in creating and achieving those objectives. There are many different kinds of economic advisors that it can be a little bit frustrating. The kind to use relies on your needs and goals. A few of the significant kinds of financial consultants consist of: He or she has actually been granted the CFP designation by the CFP board and is extremely certified to suggest you on a large range of subjects.

If you're just starting to spend, a robo-advisor is a great initial factor., you'll fill up out a set of questions that determines your danger resistance and analyzes your goals, and your robo-advisor picks your investment profile.

Not known Factual Statements About Summit Business Advisors Llc

It's absolutely the set-it-and-forget-it version. If you're a high-net-worth person, you might need someone to offer you customized, tailored guidance and make financial choices on your part. That's a riches manager. They have strong expertise in taking care of investments, estates and tax planning and other economic subjects. If you're looking for somebody to support you on to fulfill your objectives or you have some basic monetary questions, you may desire to get the assistance of a monetary train or monetary specialist.

To accomplish your objectives, you may need a competent professional with the best licenses to aid make these plans a reality; this is where a financial consultant comes in. Together, you and your advisor will cover several subjects, including the amount of cash you should save, the kinds of accounts you need, the kinds of insurance you ought to have (including long-lasting care, term life, disability, and so on), discover this and estate and tax planning.

On the questionnaire, you will likewise suggest future pensions and revenue resources, task retirement (https://www.imdb.com/user/ur190153715/?ref_=nv_usr_prof_2) needs, and explain any kind of long-term economic responsibilities. Basically, you'll provide all current and predicted investments, pensions, gifts, and incomes. copyright ProAdvisor. The spending element of the survey touches upon more subjective subjects, such as your threat resistance and risk capability

Rumored Buzz on Summit Business Advisors Llc

It will take a look at sensible withdrawal rates in retired life from your portfolio properties. Furthermore, if you are married or in a lasting collaboration, the plan will take into consideration survivorship issues and financial circumstances for the enduring companion. After you assess the plan with the consultant and change it as required, you await action.

It is very important for you, as the customer, to understand what your organizer suggests and why. You must not adhere to an expert's referrals unquestioningly; it's your money, and you need to comprehend exactly how it's being released. Keep a close eye on the costs you are payingboth to your consultant and for any type of funds acquired for you.

The Facts About Summit Business Advisors Llc Uncovered

The average base income of a financial expert, according to Without a doubt as of June 2024. Any individual can function with a monetary consultant at any age and at any kind of stage of life.

Financial consultants work for the client, not the company that employs them. They must be responsive, ready to describe financial ideas, and keep the customer's best rate of interest at heart.

A consultant can suggest feasible renovations to your plan that could assist you achieve your goals better. If you don't have the time or rate of interest to manage your finances, that's another good reason to work with a financial consultant. Those are some basic reasons you could need an expert's professional assistance

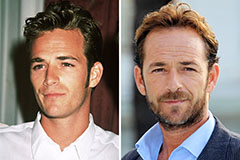

Luke Perry Then & Now!

Luke Perry Then & Now! Melissa Joan Hart Then & Now!

Melissa Joan Hart Then & Now! Freddie Prinze Jr. Then & Now!

Freddie Prinze Jr. Then & Now! Jeri Ryan Then & Now!

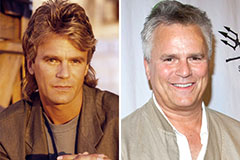

Jeri Ryan Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now!